Business Insurance in and around Aiken

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Ridge Spring

- Warrenville

- Williston

- North Augusta

- New Ellenton

- Jackson

- Montmorenci

- Monetta

- Wagener

- Windsor

- Perry

- Aiken

- Augusta

- Edgefield

Your Search For Fantastic Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like business continuity plans, worker's compensation for your employees and extra liability coverage, you can feel secure knowing that your small business is properly protected.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a HVAC company, a pet groomer, or an ice cream shop, having the right protection for you is important. As a business owner, as well, State Farm agent Hannah Swanson understands and is happy to offer exceptional service to fit what you need.

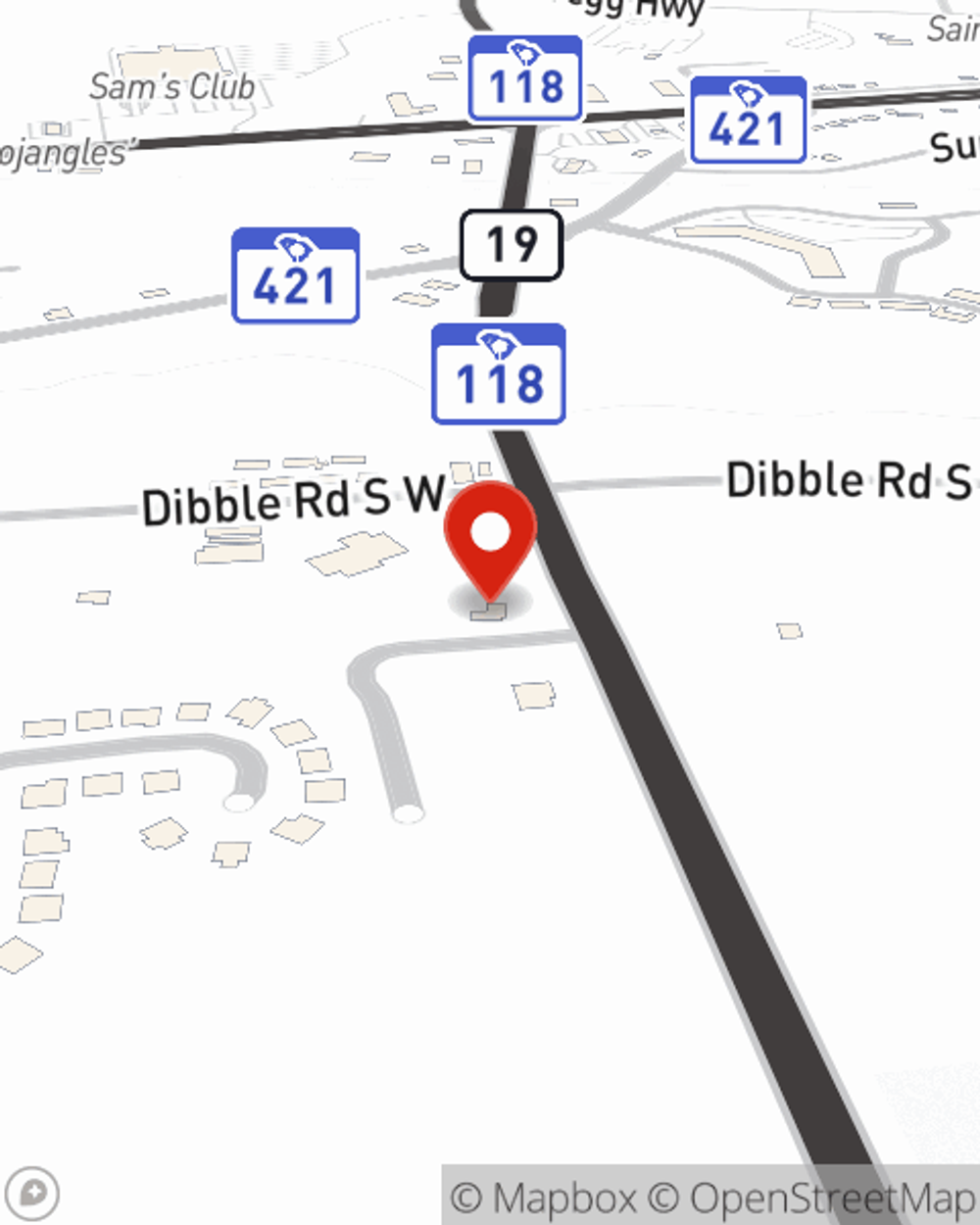

Ready to explore the business insurance options that may be right for you? Stop by agent Hannah Swanson's office to get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Hannah Swanson

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.